RPC (RES)·Q4 2025 Earnings Summary

RPC Inc Q4 2025 Earnings: Revenue In-Line, EPS Misses on Holiday Weakness

February 3, 2026 · by Fintool AI Agent

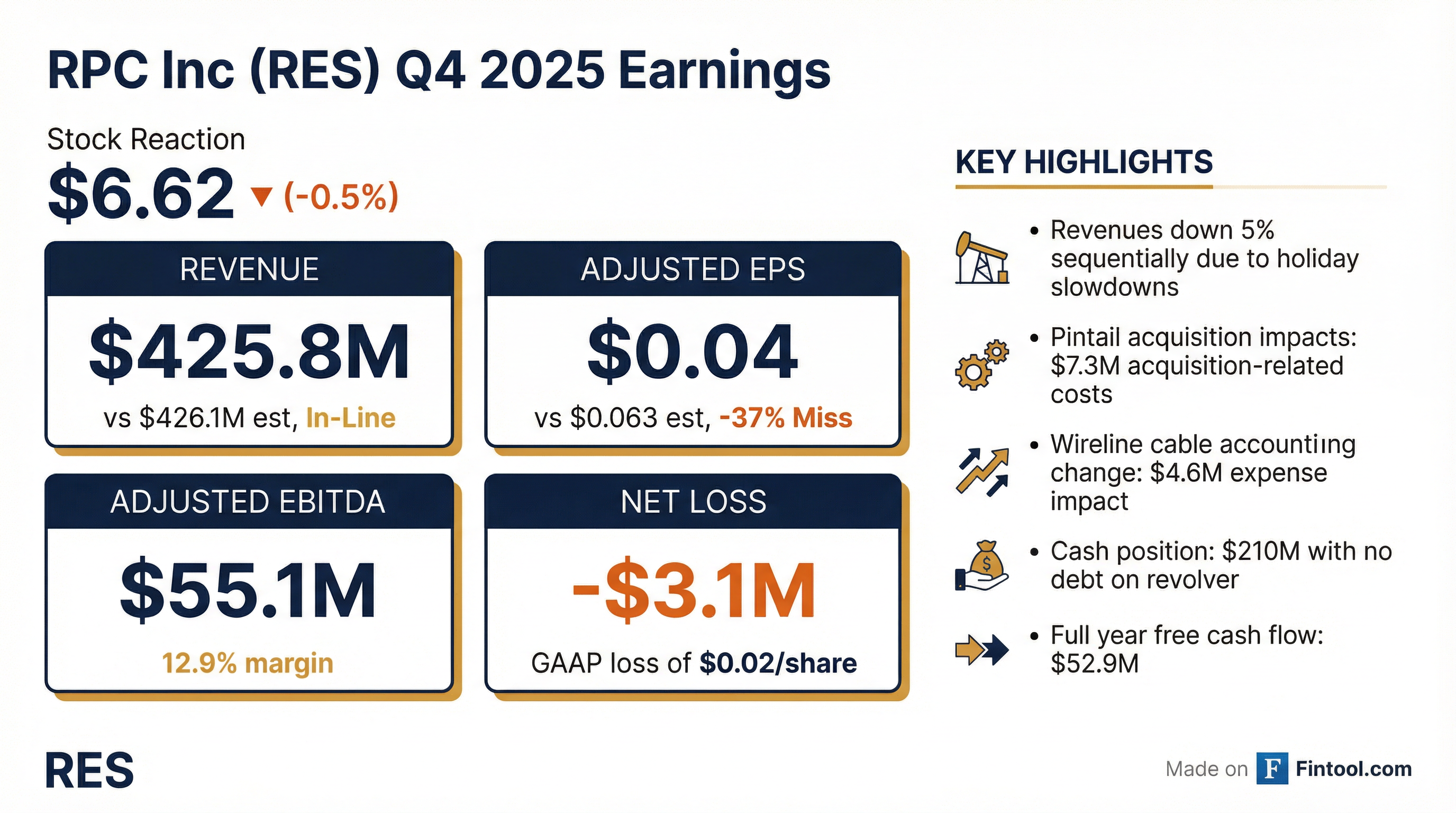

RPC Inc (NYSE: RES) reported Q4 2025 results that showed resilience on the top line but significant profit pressure. Revenue of $425.8M was essentially in-line with the $426.1M consensus, but adjusted EPS of $0.04 missed expectations by 37% due to holiday slowdowns, wireline cable accounting changes, and acquisition-related costs from the Pintail Completions deal.

The oilfield services company posted a GAAP net loss of $3.1M ($0.02 per share), compared to net income of $13.0M in Q3 2025, marking a sharp sequential deterioration as December activity fell off significantly.

Did RPC Inc Beat Earnings?

The EPS miss was driven by three key factors:

- Wireline cable accounting change: Beginning in Q4, RPC began expensing wireline cables that were previously capitalized, adding ~$4.6M in expenses during the quarter. CFO Mike Schmidt explained the business changed around the Pintail acquisition—more Simulfrac and travel frac work means cables wear out faster (under 1 year vs. 18 months previously)

- Acquisition-related employment costs: $7.3M in non-cash charges from the Pintail Completions acquisition

- Unusually high tax rate: Due to liquidation of company-owned life insurance policies from the dissolved non-qualified supplemental retirement plan

What Did Management Say?

CEO Ben Palmer was cautiously optimistic but acknowledged significant macro headwinds:

"2025 was a challenging year, with year-end oil prices reaching its lowest level since COVID. While we have seen recent improvement in oil and gas, natural gas prices, we need further increases to disperse significant customer activity levels."

On strategic positioning through the downturn:

"RPC's focus remains on leveraging our strong balance sheet and maximizing long-term shareholder returns. We continue to strategically grow our less capital-intensive service lines, both organically and through acquisitions."

Q1 2026 Weather Warning: Management flagged that winter storms in early January impacted operations across their Permian and MidCon footprint:

"Many of our businesses have been impacted by recent winter storms early in the first quarter... These lost operating days are not fully recoverable, and the associated costs incurred will impact near-term profitability."

Management highlighted that rental tools saw a 22% sequential decline with several jobs shifting into early 2026, suggesting some recovery potential in Q1.

How Did the Segments Perform?

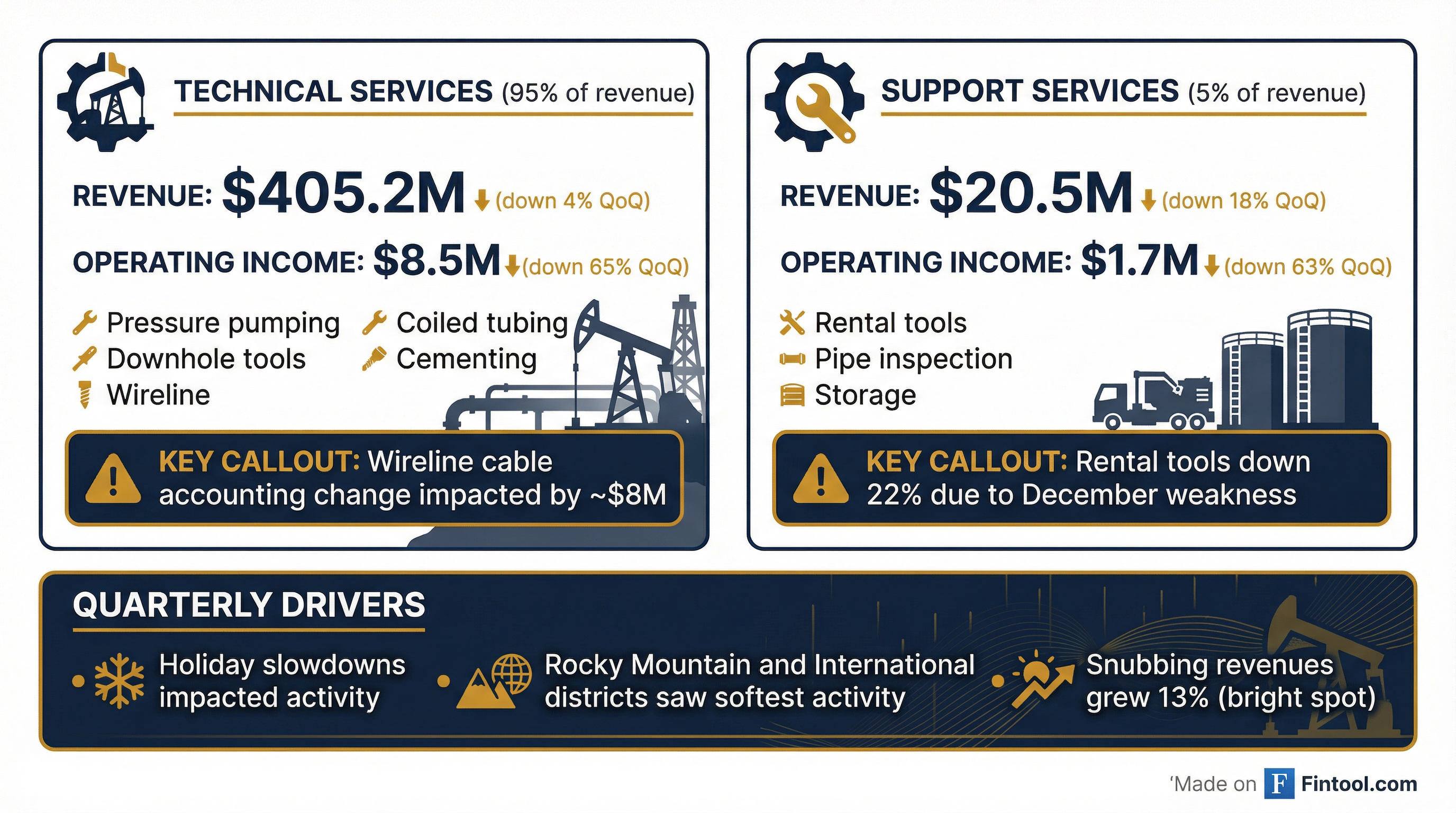

Technical Services (95% of Revenue)

- Thru Tubing Solutions downhole tools declined 9% driven by softer Rocky Mountain and International activity

- Cudd Energy Services pumping and Pintail wireline declined 6% and 3%, respectively

- Bright spot: Cudd Pressure Control snubbing revenues grew 13%

Technology Developments:

- A10 Motor: New downhole motor designed for longer laterals and higher flow rates has driven "incremental share gains"

- Metal Max: Metal-on-metal power section enabling shorter motor design, higher torque, and expansion into new markets

- UnPlug Technology: Reduces or eliminates need for bridge plugs during completions; adoption "steadily increased"

Support Services (5% of Revenue)

- Patterson Services rental tools fell 22% as jobs shifted into 2026

Q&A Highlights: What Analysts Asked

Fleet Reactivation Timing

When asked about bringing back the idled pumping fleet, CEO Palmer set a high bar:

"We're not in a panic to try to put that fleet back to work. We wanna make sure we're comfortable that it's gonna be generating probably better cash flow than we've recently been experiencing... We would want to present a pretty high probability that we would have an incremental benefit from bringing it back into service."

Translation: Don't expect reactivation without both higher pricing AND sustained activity—not just one or the other.

M&A Strategy: Widening the Aperture

Management signaled willingness to look beyond traditional oilfield services:

"We're opening up the aperture of what's the possible... We've been doing some things that are on the edges of other parts of energy, like some of the gas storage work. We're opening up the aperture to look at even more broadly than we may have in the past."

The company is building a big bore snubbing unit specifically for cavern gas storage work, with a multi-year customer contract in place—part of their diversification strategy.

Stock Buybacks vs. M&A

On capital allocation priorities with $210M in cash:

"Buybacks are certainly one of those choices, and we'll just have to see... I wouldn't see us necessarily in the near term doing anything dramatically different, but that's in the tool chest, and we're looking at it."

Competitor Dynamics

When asked about equipment moving overseas and competitor stress:

"We've heard of some competitors in some of those other service lines that are obviously reorganizing or being sold, absorbed by other competitors. So perhaps that is an indication that the market stress is getting to some of the less well-capitalized companies, and hopefully that'll inure to our benefit as we move forward."

Pressure Pumping Spot Market

On the competitive environment for pumping services:

"We're not seeing anything dramatic yet at this point... Some mom-and-pops out there are difficult to compete with. But we continue to support pressure pumping, but we're focused on some of the other service lines that are less capital intensive."

How Did the Stock React?

RES shares were roughly flat following the earnings release, trading at $6.62 (-0.5% from prior close of $6.65). The muted reaction suggests the market had already priced in weakness given the challenging oil price environment.

*Values retrieved from S&P Global

The stock has rallied 15% from its 50-day moving average, indicating the market had already turned more constructive ahead of earnings.

What Changed From Last Quarter?

Key sequential changes worth monitoring:

Notable changes:

- Oil prices fell 9% sequentially, creating headwinds for customer spending

- Natural gas prices rose 21%, potentially benefiting gas-focused services

- U.S. rig count stabilized, up slightly vs Q3 but still down 6.5% year-over-year

Balance Sheet and Capital Allocation

RPC maintains a strong balance sheet that provides flexibility through the downturn:

2025 Capital Allocation:

- Dividends paid: $35.1M ($0.16/share annualized)

- Share repurchases: $2.9M (tax withholding only)

- Capital expenditures: $148.4M

- Free cash flow: $52.9M

Cash declined $116M year-over-year, primarily due to the $153M Pintail Completions acquisition that closed in April 2025.

2026 CapEx Guidance: $150M-$180M, but CEO Palmer emphasized flexibility:

"Everybody understands that at the end of the day, the free cash flow is where the rubber meets the road... If it's in the budget, that doesn't mean it can be spent, so we scrutinize it very carefully."

Full Year 2025 Results

Revenue growth of 15% was driven primarily by the Pintail Completions acquisition, while organic revenue declined with the softer oilfield services market. Adjusted EBITDA held flat year-over-year, demonstrating operational resilience despite pricing pressure.

Key Risks and Concerns

Management highlighted several risks in their forward-looking statements:

- Oil price volatility: WTI at ~$60/bbl is below most E&P breakeven levels

- Tariff exposure: May increase cost of materials and impact profitability

- Geopolitical risks: Venezuela actions, OPEC+ decisions, political instability

- Customer spending: Lower oil prices typically lead to reduced drilling activity

- Integration risk: Continued Pintail integration costs through 2026

What to Watch for Q1 2026

- Weather impact warning: Management cautioned that early January winter storms hit Permian and MidCon operations hard—"lost operating days are not fully recoverable"

- Jobs shifted from December: Management noted several rental tool jobs pushed into Q1, but weather may offset this recovery

- Oil price trajectory: Crude volatility remains the key swing factor; "need further increases to disperse significant customer activity levels"

- Pintail synergies: $20.3M in acquisition costs recognized in 2025; watch for normalization

- Wireline cable normalization: Q4 included catch-up adjustments; going forward should be cleaner

- Fleet reactivation: Idled fleet won't return without "incrementally better pricing"—expect continued discipline

Consensus Estimates (Forward):

*Values retrieved from S&P Global

RPC Inc will hold a conference call on February 3, 2026 at 9:00 a.m. ET. The webcast will be available at www.rpc.net.

Related: